Record inflation caused by the Biden Administration’s mismanagement of the U.S. economy will leave many low-income parents feeling like they’ve been visited by The Grinch come Christmas. Recent polling by the Associated Press found that six out of every ten Americans believe gift prices are higher than usual this year.

The same survey found nearly half of all families with an annual income of less than $50,000 felt pushed to cut back on holiday shopping by as much as 20 percent, according to an estimate furnished by America’s Research Group.

The survey results are an anecdotal affirmation of a study recently released by Penn-Wharton that found the inflation that has returned with such vigor during the Biden presidency after being marginal over the last several decades has reduced the average American family’s purchasing power by as much as $3,500.

The politicians who are struggling to find a way to resolve the mounting inflation crisis have become the object of ridicule in recent days due to their incompetence. Consider this observation from noted economist Richard Rahn, head of the Institute for Global Economic Growth:

The folks in government want you to know that even though many prices such as oil are up 45 percent and food up 22 percent over the last year, there are other very important products such as toys, whose prices have been falling, down 27 percent over the past year. So, if you buy more toys and less gasoline and food, your real income in terms of purchasing power will remain the same.

Inflation is the canary in the coal mine. It’s a leading indicator that rough seas are ahead for the economy. The International Monetary Fund reports that, among the top 35 developed nations, the United States now has the highest level of inflation. The National Federation of Independent Business recently announced a “historically high number” of small businesses are saying the general economic situation is forcing them to raise prices.

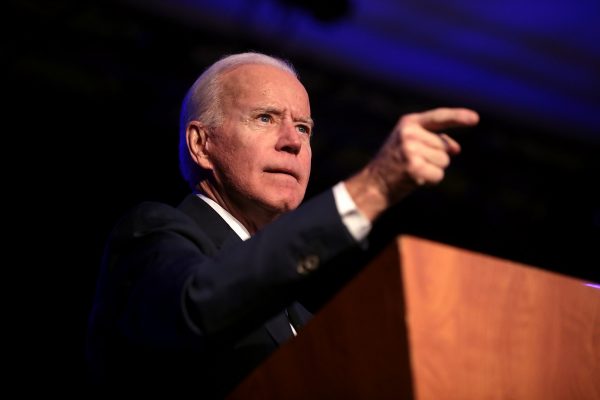

President Biden has been criticized repeatedly for failing to take the issue of inflation seriously. His proposals to continue the orgy of spending and borrowing that began under his predecessor during the COVID pandemic have made matters worse. For example, his so-called stimulus package contributed, according to the San Francisco Federal Reserve, to the rise in inflation while making the labor shortage worse.

Federal Reserve officials have been warning quietly since October of the growing risks inflation poses to the post-lockdown recovery. Numerous studies have shown the states that re-opened quickly – or never shut down at all – doing much better economically and are recreating more jobs than those that locked down and remained that way for much of the year.

Unfortunately for the president, the future is not rosy and bright. According to a recent release from the Gallup organization, the outlook of investors “has worsened” in recent months and they are far less bullish on the prospects for economic growth than they were in the first half of 2021.

“The overall effect is a decline in the Gallup Investor Optimism Index,” the firm reported, “from +39 in the prior survey (conducted in the second quarter) to +10 in the fourth,” putting it close to its lowest point since the pandemic began.

Rahn, among other economists, remains pessimistic. In a recent column, he went on at length regarding the failure of Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen to realize inflation was not “transitory,” especially with consumer prices are now rising at an almost 7 percent annual rate and producer prices at a 10 percent.

“They would not have been surprised if they had been reading this column over the past year, looking over the WSJ editorial page or watching Larry Kudlow, Steve Moore and Art Laffer on Fox,” he wrote. “The Fed has several hundred economists working for it (many from the “best schools”), yet its forecast record over the last couple of decades is far worse than most of its private sector peers.”

Too much money leads to inflation. The Biden Administration wants to print and borrow as much as it can as part of its now moribund Build Back Better program. If it continues its current path, there will be little or nothing to build back, better or otherwise.